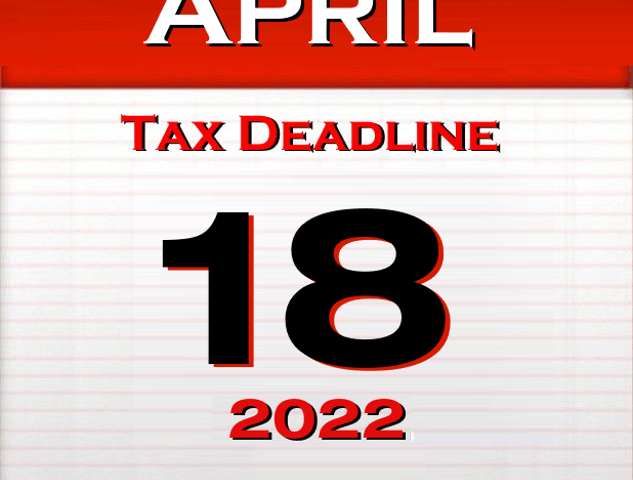

Income Tax Department Extended Hours for Filing 2022 Income Tax Returns

Port Clinton Income Tax

March 25, 2022

Baumann Auto Center donation saves the day!!

June 22, 2022Income Tax Department Extended Hours for Filing 2022 Income Tax Returns

Port Clinton Income Tax Office Extended Hours:

April 6 – 8am-5pm

April 8 – 7am – 4pm

April 11 – 8am – 5pm

April 12 – 8am-5pm

April 13 – 7am-6pm

April 18 – 8am-5pm

*Your return must contain the following.

1. Completed and signed City Income Tax Return – forms are available at City Hall or online

a. Phone Number and Email are required b. Social Security Numbers are required

2. Copies of all W2s, W2Gs, 1099s, Etc.

3. Copy of your Federal Income Tax Return (1040) and ALL Schedules, Statements & Explanations. Ensure that you have ALL pages of your schedules. Most schedules are 2-3 pages

4. Payment of Taxes Due

5. Estimated Payment for Tax Year 2022 if required. a. If tax liability is $200 or more, taxpayers are required to make estimated payments If it is missing any items, it will be returned. The return and all items including payment and estimates (if applicable) must be submitted/postmarked on or by April 18th. to be considered on time. If mailing the return, ensure that the post office has post marked your return.